The A14 Weekly Option Strategy Workshop

A weekly trade to grow your account quickly.

What is the A14 Weekly Option Strategy?

The A14 Weekly Option Strategy is a short term, high probability market neutral options strategy. It is suitable for small or large account and has simple entry and adjustment rules.

Amy Introduced the A14 Weekly Option Strategy Workshop

on the Round Table on December 1, 2021

About Amy Meissner

Amy�s specialty is options trading for monthly income using high probability option strategies. She is an active member in the options trading world, and is a sought-after webinar leader. Within the professional options trading community, Amy is known as a stable, disciplined trader who calmly manages her risk throughout the life of the trade even in volatile market conditions. She will tweak her approach slightly from time to time, making small adjustments here and there as the market moves and changes, but consistency is her distinguishing virtue. Amy's steady confidence and sound methodology have rewarded her with steady returns, year after year.

What is the A14 Weekly Option Strategy?

The A14 Weekly Option Strategy is Amy's latest iteration in her trading journey.

Amy is well known for teaching several trading systems including:

- The Asymmetric Iron Condor (aka "the Weirdor")

- The Nested Iron Condor

- The Timezone Trade

- The 14-Day Asymmetric Iron Condor

Amy wanted to address challenges with the Boxcar and other short term trading strategies. She also wanted a weekly strategy that was suitable for small or large account with high returns.

Since September 2020, Amy started live testing new ideas that combined a variety of trading tactics. The results are fantastic.

How Were Amy's Live Trading Results?

In a word... Outstanding

Amy started with a $32,447.49 account in September 2020.

In the 15-month period that followed, she deposited another $29,661.02 for a total cash outlay of $62,108.51.

What happened with Amy's account?

Something extraordinary

Amy's account today is $204,545.76!

The net profit was $142,437.30 including all fees! That is a 229.336% profit.

Remember that a 100% profit doubles an account.

Amy MORE THAN TRIPLED HER ACCOUNT in 15-months!

We've been watching trading systems for a long time. This is the highest yielding market neutral options performance we've seen!

This is the type of results directional traders hope for!

The A14 Weekly Option Strategy Was Born!

Amy analyzed her live trades and created a set of rules in order to be capable of getting the same results of her live trading.

The A14 Weekly Option Strategy was the end result.

A14 Weekly Option Strategy Advantages

- No need to pick direction. Don't have to be a technical analysis guru.

- Single order at entry. No need to multiple legs.

- No need to sit in front of the computer during trading hours.

- Adjustments are simple and only need to be checked once a day.

- Adjustment tactics can be used with other strategies.

A14 Weekly Option Strategy Overview

- Planned Capital is $5,000 to $8,000 for a two-lot trade.

- Minimum account is $10,000 to trade a two-lot.

- Profit target is +5% or more. Amy averaged +6.5% per trade

- Losses average ~6% and generally under -10%.

- Win/Loss Expectancy was 9:1.

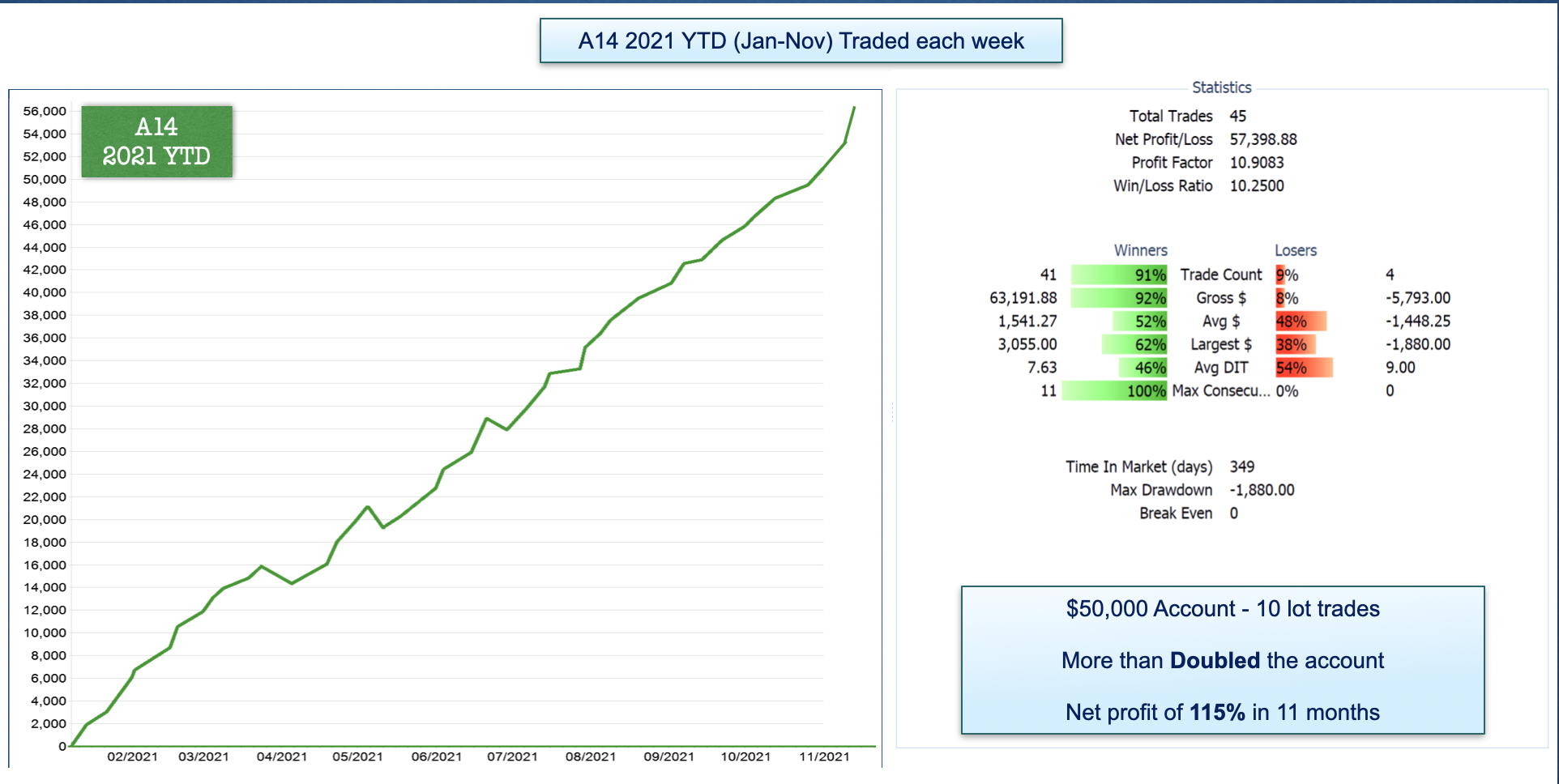

2021 Year-To-Date (YTD) Trading Statistics

What You'll Get

- Core Concepts of the A14 Weekly BWB tactics used.

- Rules and Guidelines for the A14 Weekly BWB strategy (including: Entry, Adjustments, and Exit).

- Several Step by Step Examples of the A14 in Up, Down, and Choppy markets.

- Additional Adjustment options that can be used.

- Using the A14 Adjustment strategy for the Boxcar.

- Workshop classes will be live to allow for Q&A.

- All classes will be recorded and available for playback.

Special OptionNET Explorer Discount

Amy recommends using OptionNET Explorer to manage your options trades.

OptionNET Explorer has given us a 15% discount for new subscribers. Click the button below to get this offer:

Workshops Are For Educational Purposes Only

The purpose of the A14 Weekly Option Strategy Workshop is to provide information how Amy trades.

The workshop is intended to show you examples for you get ideas for your own trades.

A14 Weekly Options Strategy Workshop

Class ended but the recordings are availabe! When you sign up, you get:

- Core concepts of the A14 Weekly Options Strategy

- Rules and guidelines for the A14 Weekly Options Strategy (including entry, adjustment and exit)

- Several step-by-step examples of the A14 in up, down and choppy markets

- Additional adjustment options that can be used

- Using the A14 adjustment strategy for the Boxcar Trade

- Dedicated discussion forum

- All classes will be recorded and available for playback

Get Amy's A14 Weekly Options Strategy Workshop for $499

This price disappears forever when class starts on Monday, December 6!

NOTE: Your card will not be charged until Monday December 6th.

The button below prompts you to enter your billing information so we can process your order next Monday.

Copyright 2018-2024. Aeromir Corporation. All rights reserved.

Home Members Privacy Policy Billing Policy Disclaimer and Terms of Use Contact Us